Money isn’t just about income and expenses; it’s closely tied to our sense of safety, identity, and self-worth. When financial strain becomes constant or severe, it can trigger more than just temporary stress. For many, it leads to economic trauma, a deep psychological response to long-term money-related hardship that can impact both mental and emotional health.

If you’ve ever felt anxious just thinking about your finances, lost sleep over debt, or felt emotionally drained from ongoing financial struggles, you’re not alone. These aren’t just everyday worries; they may be signs of economic depression, where persistent financial pressure contributes to feelings of fear, shame, sadness, or even hopelessness.

In this article, we’ll break down what financial trauma is, explore the emotional and psychological symptoms it causes, and share supportive steps to help you move toward recovery, both mentally and financially.

What is Financial Trauma?

Financial trauma is a psychological response to intense or prolonged money-related stress.

It often stems from overwhelming hardship, like job loss, chronic debt, or poverty, that leaves lasting emotional effects. This trauma can impact mental well-being long after the financial crisis ends. It’s more than stress; it’s a deep emotional imprint caused by financial instability.

Unlike typical money stress, which can be addressed with planning, financial trauma runs deeper. It can disrupt your ability to make decisions, cause fear or panic around money, and erode your sense of safety. Feelings like guilt, shame, or helplessness may arise even in everyday financial situations. This emotional burden can linger, affecting how you view yourself and your finances.

People affected by financial trauma often:

- Avoid checking bank statements or managing bills

- Feel extreme anxiety around spending, even on necessities

- Experience persistent feelings of inadequacy or failure

- Relive past financial crises, even when their current situation improves

Over time, financial trauma can lead to serious mental health issues like anxiety, low self-worth, or financial depression. It is especially common in those who grew up in poverty, faced bankruptcy, or lost income suddenly. The emotional weight of financial struggle can affect relationships, work, and overall stability. Recognising it is the first step toward healing and reclaiming control.

Understanding this trauma is the first step toward healing and reclaiming control over both your finances and your emotional well-being.

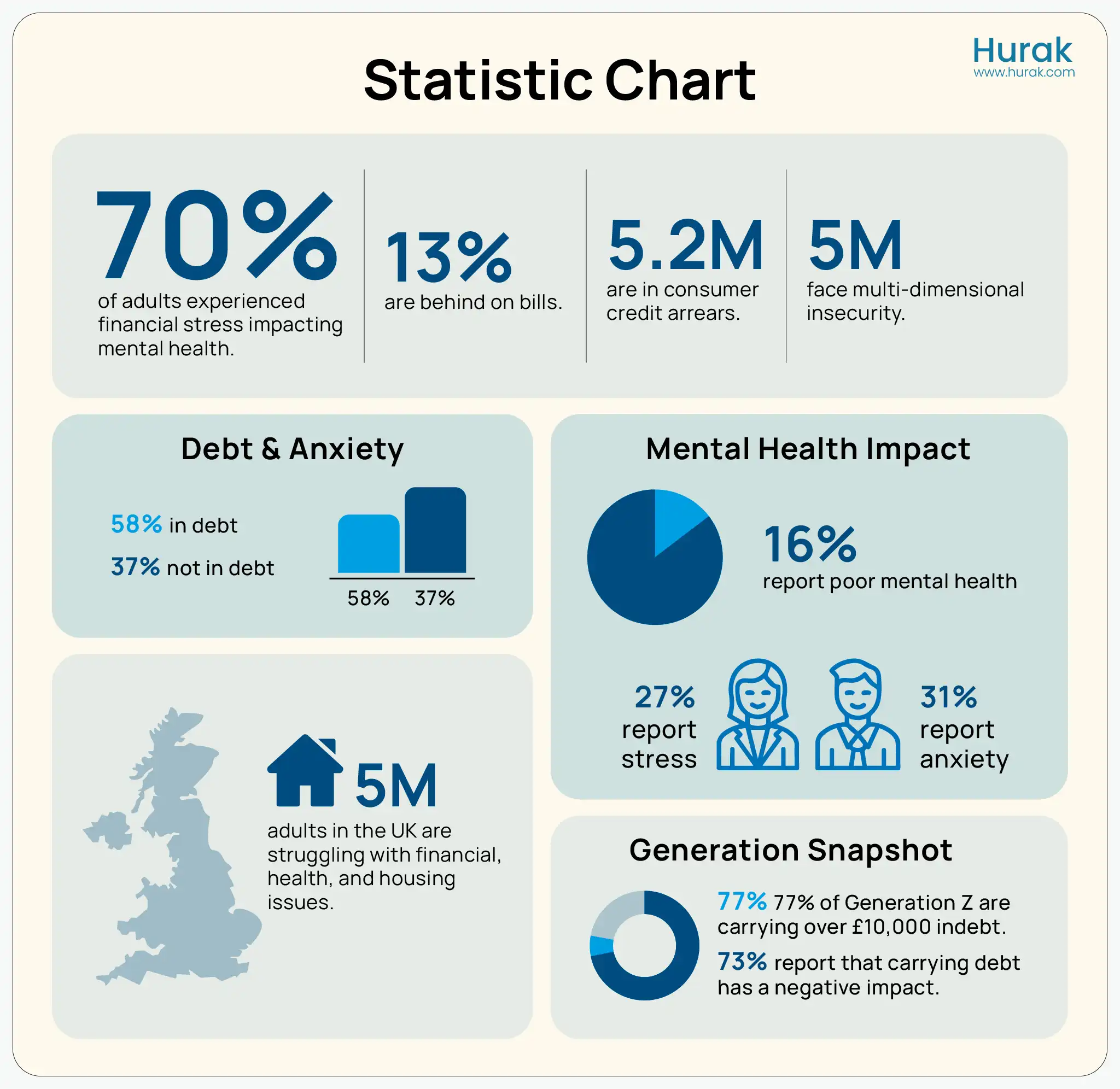

Financial trauma affects nearly 1 in 4 adults, with 55% citing money as a major source of stress. For 30%, financial strain even impacts personal relationships, showing that the effects go far beyond the bank account.

Here is an infographic of the statistics for better understanding:

Signs and Symptoms of Financial Trauma:

Financial trauma can manifest in both emotional and physical ways, often without someone fully realising the root cause is related to money stress. Here are some common signs and symptoms of emotional, psychological, and physical issues:

Emotional & Psychological Symptoms

- Constant worry about money, even when basic needs are met

- Feelings of shame, guilt, or embarrassment about finances

- Avoidance behaviours like ignoring bills, bank statements, or financial discussions

- Low self-worth or hopelessness, especially tied to financial status

- Panic or anxiety when spending money, even on essentials

- Depression symptoms, such as fatigue, withdrawal, or lack of motivation, are due to financial strain

Physical & Behavioural Signs

- Sleep disturbances related to money worries

- Stress-related health issues, like headaches, high blood pressure, or digestive problems

- Impulsive financial decisions (e.g., overspending or avoidance of money entirely)

- Overworking or burnout, driven by the fear of financial instability

What Causes Financial Trauma?

| Cause | Description |

| Sudden Job Loss or Income Reduction | Losing a job or experiencing an unexpected cut in income |

| Chronic Financial Struggle | Ongoing difficulty in meeting basic needs like housing, food, or healthcare |

| Debt and Collection Pressure | Overwhelming debt or aggressive contact from debt collectors |

| Growing Up in Poverty | Childhood exposure to long-term financial strain and instability |

| Major Life Transitions | Events like divorce, medical emergencies, or the death of a primary earner |

| Financial Abuse or Manipulation | One partner controls another’s access to money or financial decisions |

Whether you’re feeling stuck, overwhelmed, or experiencing financial depression symptoms, support is available. Take small steps. Ask for help. Hurak’s Mental Health First Aid courses empower you with the skills to recognise the signs, offer initial support, and guide someone toward professional help.

How to cope with financial trauma?

Recovering from financial trauma isn’t just about fixing your bank balance; it’s about healing the emotional and psychological wounds left by prolonged financial strain. Coping takes time, but with the right steps, support, and mindset, you can regain control over both your money and your mental well-being.

Acknowledge the Impact

The first step is recognising that your emotions around money are valid. If you’re experiencing financial depression symptoms, such as anxiety, low mood, or hopelessness, it’s important to understand that these feelings may be linked to past or ongoing financial struggles. Suppressing or ignoring them can deepen the trauma.

Talk to Someone

You don’t have to go through this alone. Speaking with a therapist, particularly one familiar with trauma or financial stress, can help untangle the emotional toll. There are also UK-based mental health charities and free services that understand the link between financial depression and mental well-being.

Create a Simple Financial Plan

Financial trauma can make even basic money tasks feel overwhelming. Start with small, manageable steps, like listing your expenses or setting a realistic weekly budget. Tools like financial planners, debt helplines, or free online budgeting apps can ease the pressure of financial struggle.

Set Boundaries Around Money

If your trauma stems from financial manipulation or shared finances, set emotional and practical boundaries. This might include creating a separate account, automating bills, or limiting conversations that trigger anxiety.

Celebrate Small Wins

Progress doesn’t always mean a zero balance on your credit card. Paying one bill, tracking your spending for a week, or resisting the urge to avoid your finances are all victories. Acknowledging these helps rebuild confidence and reduces the feeling of failure often tied to financial depression.

Connect with Supportive Communities

Look for online or local groups where people share similar experiences. Knowing others understand your financial strain can reduce isolation and provide emotional relief. You might even find practical tips that worked for someone else.

Conclusion

Financial trauma is real, and you’re not alone in facing it. Whether it stems from debt, job loss, or long-term financial strain, its impact can go far beyond your bank balance, affecting your mental health, relationships, and overall sense of stability.

Recognising the signs of financial trauma is the first step toward healing. From understanding financial depression symptoms to seeking professional support or building healthier money habits, recovery is possible, with time, compassion, and the right tools.

FAQs

What is financial trauma, and how is it different from regular money stress?

Financial trauma is a deep, lasting emotional response to intense or prolonged financial hardship. Unlike everyday money stress, it often stems from events like job loss, poverty, or overwhelming debt, and can lead to anxiety, depression, and avoidance behaviours.

What are the signs that I may be experiencing financial trauma?

Common signs include constant worry about money, avoiding financial decisions, feelings of shame or guilt, panic when spending, sleep problems, and symptoms of financial depression, such as low mood or emotional withdrawal.

Can financial trauma affect my mental health long-term?

Yes. Financial trauma can contribute to anxiety disorders, chronic stress, low self-esteem, and depression. Left unaddressed, it may also impact relationships, work performance, and overall well-being.

How do I start healing from financial trauma?

Healing starts with acknowledging your emotions around money, seeking mental health support, setting realistic financial goals, and building healthier money habits gradually. Compassion and patience are key.

Is financial trauma common in the UK?

Yes, especially in times of economic uncertainty. Many people in the UK experience financial strain due to cost-of-living pressures, debt, and income instability, making financial trauma a growing concern across all age groups.

Explore our other courses

- Emergency First Aid at Work

A practical, one-day course ideal for low-risk workplaces. This hands-on training equips participants with the core skills and confidence to handle medical emergencies quickly and effectively. - First Aid at Work

A comprehensive, three-day, Ofqual-regulated Level 3 course designed for high-risk environments such as construction sites, factories, and warehouses. Perfect for designated workplace first aiders needing in-depth training. - Paediatric First Aid

A two-day, Ofqual-regulated course focused on providing life-saving care to infants and children up to puberty. Ideal for childcare professionals, school staff, and parents. - Basic First Aid Course

An accessible, self-paced course for anyone seeking foundational first aid knowledge. Great as a general introduction or an annual refresher to stay up to date. - Advanced First Aid Course

An in-depth, fully online Level 3 course for those looking to enhance their first aid expertise beyond the basics. Suitable for individuals wanting to take on more advanced responsibilities in emergencies.